Tracking the Latest Pay Transparency Trends: 5 Compliance Tips for Employers

Insights

1.29.25

The federal government made headlines last week by rolling back a slew of workplace obligations, but employers should be prepared for heightened requirements at the state and local level. Indeed, blue states are expected to up their game this year in resistance to the Republican trifecta in the White House, Senate, and House – and pay transparency will continue to be one of the hottest topics. This trend has already impacted many businesses in various locations across the country, and we think more employers will be grappling with new compliance obligations by the end of the year. Here’s what you need to know about pay transparency laws and five tips for compliance.

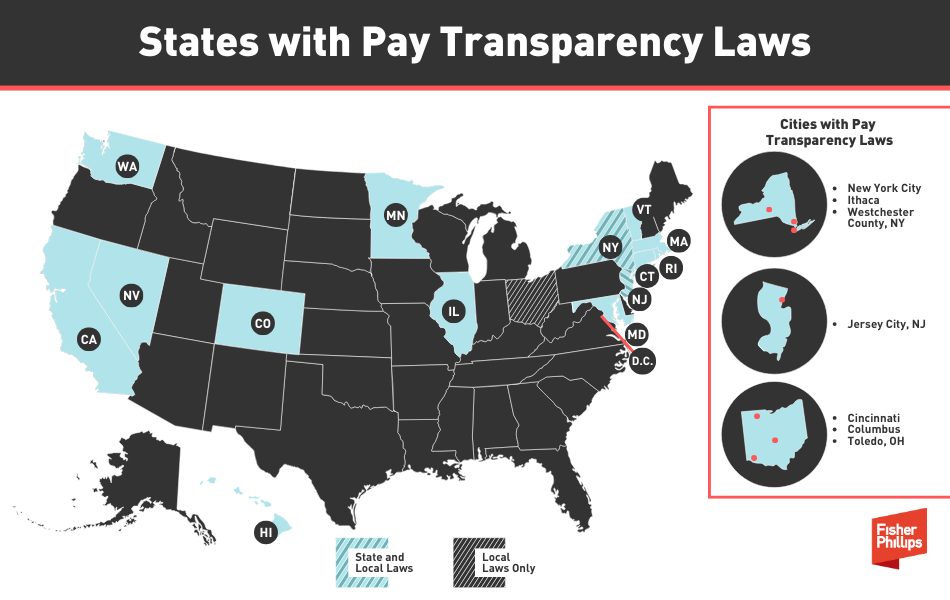

1. Keep Up with the Patchwork of New State Laws

In addition to rules on equal pay for equal work, many states are now requiring employers to disclose salary ranges in job listings and for promotional opportunities. Pay transparency affects all aspects of workplace relationships – including hiring, recruitment, and retention efforts; supervision and leadership; and compensation and benefits. Here are the main laws on this topic that may impact your business so far:

- Colorado was the first state to enact a pay transparency law in 2021 and other states rapidly followed suit, including California, Connecticut, Hawaii, Illinois, Maryland, Minnesota, Nevada, New York, Rhode Island, Washington, and Washington, D.C.

- Most recently, New Jersey, Massachusetts, and Vermont joined the trend.

- You should also note that some cities have their own requirements, including:

- New York City, Ithaca, and Westchester County, NY;

- Jersey City, NJ ; and

- Cincinnati, Columbus, and Toledo, Ohio.

Many of these laws have already taken effect and others are slated for later in 2025, so you should take the time now to review the rules in your locations and ensure compliance.

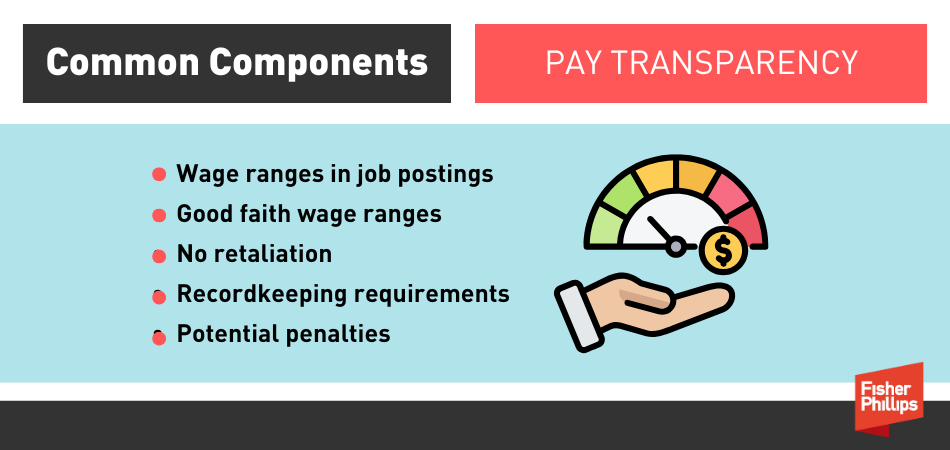

2. Understand Your Key Obligations

Multistate compliance with these laws is complicated, particularly since the details vary, including the applicable employer size and whether the rules apply to remote jobs. Although you’ll need to review the specific requirements of each law that applies to your locations, here are some common themes among pay transparency laws:

- Employers need to provide wage ranges in job postings.

- Set your wage ranges in good faith.

- You may not retaliate against applicants or current employees for requesting a position’s wage range.

- You may need to comply with certain recordkeeping requirements.

- Potential penalties may apply if the rules are not followed.

Note that some locations require disclosures about benefits offerings and other types of compensation, like bonuses and commissions. Some also require pay data reporting. For example, beginning February 1, most employers with 100 or more employees in Massachusetts must annually file an equal employment opportunity (EEO) report that contains workforce demographic and pay data categorized by race, ethnicity, sex, and job category.

3. Avoid Costly Mistakes

You should note that most pay transparency laws include penalties for violations. For example, in Illinois:

- The employer has 14 days to cure a first offense, seven days for a second offense, and no cure period for a third or subsequent offense.

- If the violation on an active job posting is not remedied within the cure period, the employer will be subject to a civil penalty of up to $500 for a first offense, $2,500 for a second offense, and $10,000 for a third or subsequent offense.

- For violations on non-active job postings, the employer will be subject to a civil penalty of up to $250 for a first offense, $2,500 for a second offense, and $10,000 for a third or subsequent offense.

- A job posting is considered one posting regardless of how many duplicative postings list the job opening.

In addition to penalties imposed by the states and cities enforcing the laws, failure to comply with pay transparency laws has begun to spawn costly litigation. For example, the 2023 job posting requirements to Washington State’s pay transparency law have led to an avalanche of class action litigation filed on behalf of “job applicants” seeking to recover statutory damages in the amount of $5,000 per applicant to any noncompliant posting, plus attorneys’ fees and prejudgment interest. This illustrates the importance of developing compliant policies and practices.

A best practice is to be proactive. Pay equity and pay transparency are ongoing compliance issues that require vigilance.

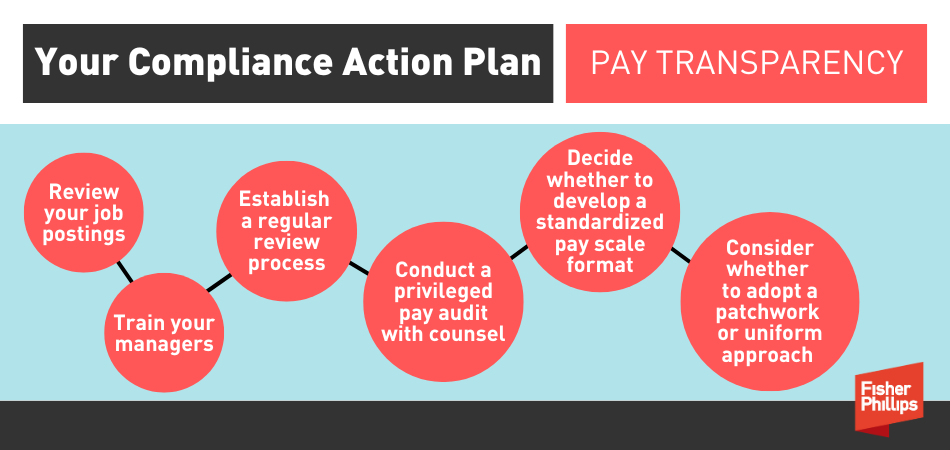

4. Create a Compliance Blueprint

Now is a good time to create or update your pay transparency compliance plan. Although your specific plan will depend on which state and local laws apply to your operations, you should generally consider taking the following steps:

- Review your job postings to ensure compliance with all applicable obligations.

- Train your hiring managers, talent acquisition professionals, and human resources employees on the requirements.

- Establish a regular review process so that you can evaluate and update your compensation and benefits on a routine basis and adjust as needed.

- Coordinate with third parties you use to assist with job postings to ensure they are complying with the applicable requirements, if needed.

- Conduct a privileged pay audit with counsel to ensure compliance with federal, state, and local equal pay requirements. (More on this below.)

- If necessary, consider working with your counsel to develop a standardized pay scale format to ensure you comply with pay equity principles.

- If you have operations in states with different requirements or in other states that do not require such transparency, consider whether you will adopt a patchwork approach or a uniform approach to job postings. There are pros and cons to each approach, but you will want to work with your legal counsel to understand your options.

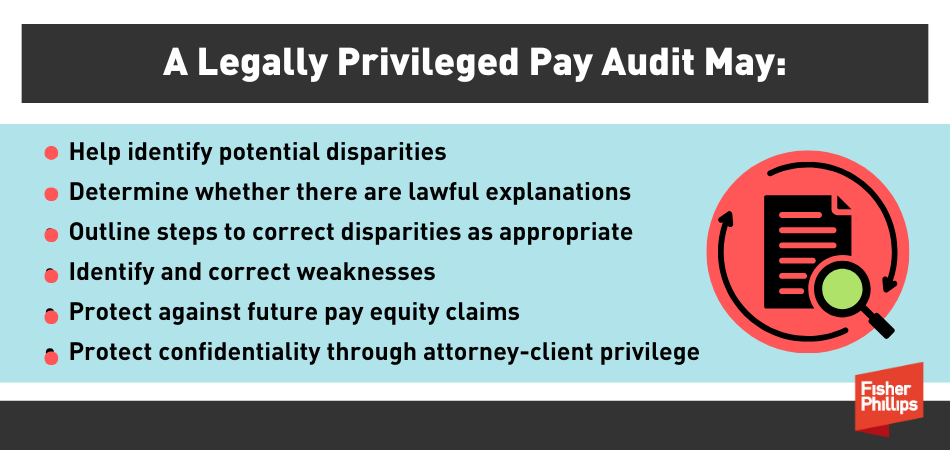

5. Conduct a Privileged Audit

In addition to tracking and complying with pay transparency laws, you should consider the bigger picture when it comes to pay equity in general:

- The federal Equal Pay Act (EPA) requires you to provide men and women in your workplace with equal pay for equal work. Under federal law, disparities in pay among employees with substantially equal job duties are only legally permissible if based on a factor other than sex, such as seniority, merit, qualifications, skills, education, or level of responsibility.

- Moreover, many state laws go well beyond federal law in terms of scope and lawful justifications for pay differentials.

- Nearly every state has its own law that also prohibits gender-based wage discrimination.

- Many states – including California, New York, New Jersey, and Oregon – have also expanded their pay equity laws to go beyond gender and extend to other legally protected categories, including race, ethnicity, age, and religion.

One of the best ways to determine whether your company has any significant pay disparities is to conduct a legally privileged pay audit. Through an audit, you will be able to identify potential pay disparities among employees performing comparable work, determine whether there are lawful explanations for those disparities, and take steps to correct them as appropriate. An audit also provides an opportunity to identify and correct weaknesses in the organization’s systems, so you can protect against future pay equity claims.

Work with legal counsel. In some locations, you may even be able to avail yourself of a legal safe harbor if you can prove you undertook a valid pay equity audit. We recommend that any such audit be conducted with advice from an attorney, preferably someone who understands the nuances of pay equity laws, so that it is cloaked with the attorney-client privilege and can remain confidential.

By conducting a privileged audit, your organization will be better positioned to ensure compliance with federal and state equal pay laws while minimizing the risk for litigation based on equal pay.

Want More?

- You can check out the FP Pay Equity Interactive Map, which allows you to explore various pay equity laws by simply hovering on each state.

Conclusion

We will continue to monitor developments throughout the country on pay equity. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. If you have questions, please contact your Fisher Phillips attorney, the authors of this Insight, or any member of our Pay Equity Practice Group.

Related People

-

- Kathleen McLeod Caminiti

- Partner and Co-Chair, Wage and Hour Practice Group

-

- Sarah Wieselthier

- Partner