The Auto Dealer’s Guide to FLSA Exemptions: An Inventory of Commonly Used Categories + Your Maintenance Plan to Stay Compliant

Insights

2.12.25

Auto dealerships employ a wide range of workers and often maintain a variety of complex pay plans, which can make compliance with federal wage and overtime rules extra challenging. Since violations of the Fair Labor Standards Act (FLSA) can result in significant penalties and costly litigation, it pays for dealers to know which employees could potentially qualify for an FLSA exemption. This Insight will provide you with an FLSA snapshot, an inventory of the exemption types commonly used by auto dealers, and a maintenance plan you can use to avoid misclassifications and potential liability. (Please note that this Insight discusses a dealership’s obligations under the federal FLSA only, and that you may be subject to additional state or local requirements depending on where you are located).

Snapshot of the FLSA’s Minimum Wage, Overtime Pay, and Recordkeeping Rules

The FLSA provides protections to covered employees who don’t qualify for any of the law’s various exemptions. For any such nonexempt employee, the employer must:

- pay at least minimum wage ($7.25 per hour);

- pay an overtime premium of at least 1.5 times the employee’s “regular rate” of pay after 40 hours of work in a workweek; and

- keep accurate records of hours worked.

Latest FLSA Developments

You may have been hearing a lot of buzz about the FLSA throughout the past year due to some key developments:

- Last year, the DOL rolled out a new overtime rule that aimed to make millions of more employees eligible for overtime pay under the FLSA – but a federal court blocked that rule in November with nationwide effect (and we had previously covered why the rule change would have had minimal effects on dealerships, anyway).

- This year, a January 15 Supreme Court ruling reduced litigation risks for employers by making it easier for them to show that employees are properly classified as exempt under the FLSA.

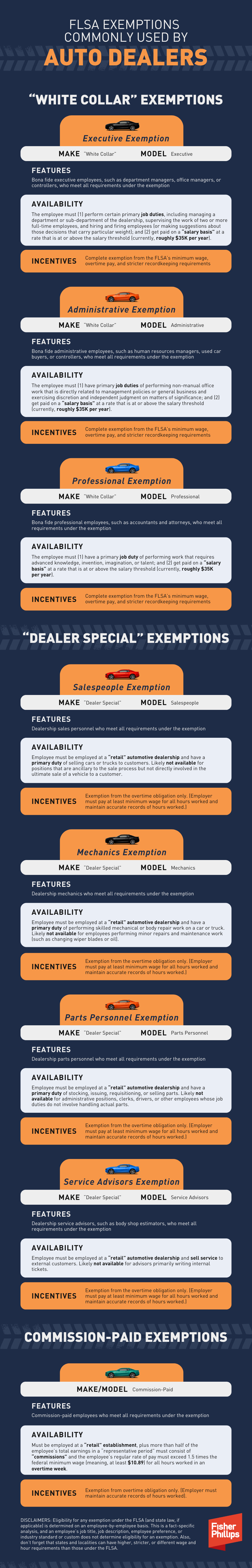

An Inventory of FLSA Exemption Categories Commonly Used by Auto Dealers

Auto dealers might have workers that qualify for one or more of the FLSA’s exemptions, including under the commonly used “white-collar” exemptions, as well as other exemptions that are uniquely available to retail automotive dealerships. We took an inventory of the FLSA exemption types most commonly used in the industry and broke down the details for each one. You can compare the options in the graphic below or scroll down for the full listings.

| DISCLAIMERS: Eligibility for any exemption under the FLSA (and state law, if applicable) is determined on an employee-by-employee basis. This is a fact-specific analysis, and an employee’s job title, job description, employee preference, or industry standard or custom does not determine eligibility for an exemption. Also, don’t forget that states and localities can have higher, stricter, or different wage and hour requirements than those under the FLSA. |

“White Collar” Exemptions

1. Executive Exemption

- Make: “White Collar”

- Model: Executive

- Features: Bona fide executive employees, such as department managers, office managers, or controllers, who meet all requirements under the exemption

- Availability: The employee must (1) perform certain primary job duties, including managing a department or sub-department of the dealership, supervising the work of two or more full-time employees, and hiring and firing employees (or making suggestions about those decisions that carry particular weight); and (2) get paid on a “salary basis” at a rate that is at or above the salary threshold (currently, roughly $35K per year).

- Incentives: Complete exemption from the FLSA’s minimum wage, overtime pay, and stricter recordkeeping requirements

2. Administrative Exemption

- Make: “White Collar”

- Model: Administrative

- Features: Bona fide administrative employees, such as human resources managers, used car buyers, or controllers, who meet all requirements under the exemption

- Availability: The employee must (1) have primary job duties of performing non-manual office work that is directly related to management policies or general business and exercising discretion and independent judgment on matters of significance; and (2) get paid on a “salary basis” at a rate that is at or above the salary threshold (currently, roughly $35K per year).

- Incentives: Complete exemption from the FLSA’s minimum wage, overtime pay, and stricter recordkeeping requirements

3. Professional Exemption

- Make: “White Collar”

- Model: Professional

- Features: Bona fide professional employees, such as accountants and attorneys, who meet all requirements under the exemption

- Availability: The employee must (1) have a primary job duty of performing work that requires advanced knowledge, invention, imagination, or talent; and (2) get paid on a “salary basis” at a rate that is at or above the salary threshold (currently, roughly $35K per year).

- Incentives: Complete exemption from the FLSA’s minimum wage, overtime pay, and stricter recordkeeping requirements

“Dealer Special” Exemptions

1. Salespeople Exemption

- Make: “Dealer Special”

- Model: Salespeople

- Features: Dealership sales personnel who meet all requirements under the exemption

- Availability: Employee must be employed at a “retail” automotive dealership and have a primary duty of selling cars or trucks to customers. Likely not available for positions that are ancillary to the sale process but not directly involved in the ultimate sale of a vehicle to a customer.

- Incentives: Exemption from the overtime obligation only. (Employer must pay at least minimum wage for all hours worked and maintain accurate records of hours worked.)

2. Mechanics Exemption

- Make: “Dealer Special”

- Model: Mechanics

- Features: Dealership mechanics who meet all requirements under the exemption

- Availability: Employee must be employed at a “retail” automotive dealership and have a primary duty of performing skilled mechanical or body repair work on a car or truck. Likely not available for employees performing minor repairs and maintenance work (such as changing wiper blades or oil).

- Incentives: Exemption from the overtime obligation only. (Employer must pay at least minimum wage for all hours worked and maintain accurate records of hours worked.)

3. Parts Personnel Exemption

- Make: “Dealer Special”

- Model: Parts Personnel

- Features: Dealership parts personnel who meet all requirements under the exemption

- Availability: Employee must be employed at a “retail” automotive dealership and have a primary duty of stocking, issuing, requisitioning, or selling parts. Likely not available for administrative positions, clerks, drivers, or other employees whose job duties do not involve handling actual parts.

- Incentives: Exemption from the overtime obligation only. (Employer must pay at least minimum wage for all hours worked and maintain accurate records of hours worked.)

4. Service Advisors Exemption

- Make: “Dealer Special”

- Model: Service Advisors

- Features: Dealership service advisors, such as body shop estimators, who meet all requirements under the exemption

- Availability: Employee must be employed at a “retail” automotive dealership and sell service to external customers. Likely not available for advisors primarily writing internal tickets.

- Incentives: Exemption from the overtime obligation only. (Employer must pay at least minimum wage for all hours worked and maintain accurate records of hours worked.)

Commission-Paid Exemptions

- Make/Model: Commission-Paid

- Features: Commission-paid employees who meet all requirements under the exemption

- Availability: Must be employed at a “retail” establishment, and more than half of the employee’s total earnings in a “representative period” must consist of “commissions.” In addition, the employee’s regular rate of pay must exceed 1.5 times the federal minimum wage (meaning, at least $10.89) for all hours worked in an overtime week.

- Incentives: Exemption from overtime obligation only. (Employer must maintain accurate records of hours worked).

Potential Consequences of FLSA Violations

While you can breathe a sigh of relief knowing that a federal court blocked the DOL’s overtime rule and SCOTUS has set a consistent standard for FLSA exemption cases, you should continue prioritizing wage and hour compliance since errors can result in significant penalties and hefty litigation costs. For example:

- Employees can file or threaten to file an FLSA lawsuit against the employer and individual managers.

- The lawsuit can be a single plaintiff case or a collective action if the employee has not signed an arbitration agreement with a class and collective waiver provision.

- Prevailing plaintiffs can be awarded attorneys’ fees that are “reasonable” – which is highly subjective.

- Liquidated damages (double damages) are available for willful violations.

- The FLSA allows employees to sue for retaliation if they suffer an adverse employment action for exercising their FLSA rights to complain.

Routine Maintenance Required for FLSA Compliance

- Take Inventory. Now’s your turn to take stock – make a list of all employees you currently treat as exempt under one of the white-collar exemptions, along with their current annual compensation structure.

- Perform an Inspection. Evaluate whether each employee on the list meets the qualifications for the applicable exemption.

- Check the Service Manual. Consider options for employees who may have been misclassified as exempt, such as making necessary changes to the employee’s primary duties or salary, determining whether any other exemptions may potentially be available, or converting the employee to nonexempt status. Work with counsel to understand your options and navigate how to make any necessary repairs.

- Repair Misclassifications. If you need to convert an exempt employee to nonexempt status, you will need to decide what changes you will make to comply with the minimum wage and overtime rules. There are countless factors to consider here – for example, will you treat the employee as salary nonexempt (even though timekeeping will be required), or will you convert their pay to an hourly rate (which can be very complicated when other moving pieces such as incentives, commissions, or bonuses are involved)? Will you expect regular overtime work or prohibit it altogether?

- Personalize Communications. Reclassifying an employee as nonexempt can have a big impact on an employee’s status, morale, and benefits. For many people, a salary is a source of pride or achievement, so being told they must now be paid on an hourly basis might feel like an insult – and it could possibly even trigger the very misclassification claims you are trying to avoid. How you communicate the message is critical, and you should aim to frame it as a benefit to the employee.

- Practice Routine Maintenance. The best way to avoid misclassification claims is to regularly review your practices and ensure job descriptions are accurate and updated. You should review your time and recordkeeping procedures; your pay plans, including whether they reserve rights and use proper terms; your employee handbook policies and procedures; and any third-party agreements for indemnification. You should also consider arbitration agreements and class action waivers. Check out our Wage and Hour Insights page for the latest compliance tips.

Conclusion

Because wage and hour issues are often more complicated than they appear, we recommend you consult with legal counsel with dealership experience to assist with compliance issues. Your Fisher Phillips attorney will be happy to assist. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, or any attorney on our Auto Dealership Team.

We will continue to monitor workplace law developments as they apply to employers in the auto dealer industry, so make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information directly to your inbox.

Related People

-

- Christopher C. Hoffman

- Regional Managing Partner

-

- Matthew R. Simpson

- Partner