Maine’s Mandatory Paid Leave Premiums Start in January: What Employers Must Know + Your 5-Step Action Plan

Insights

11.04.24

While Maine’s new Paid Family and Medical Leave (PFML) benefits won’t roll out until May 2026, the employer contribution requirements kick in this January. Starting in 2025, any employer with at least one employee in the state will be required to submit quarterly premiums and may withhold up to 0.5% of employee wages to split the cost (or cover it entirely, depending on the size of the employer). We’ll explain the new mandatory premiums and give you a five-step employer action plan for implementing them.

Quick Background

Governor Janet Mills signed a Maine budget bill into law last year that included the creation of a statewide PFML program that will, starting in May 2026, provide eligible workers up to 12 weeks of paid time off for qualifying family, medical, safe, or military leave. PFML benefits will be financed by payroll “premiums” – and employers of all sizes must remit those premiums this January to ensure sufficient funds accumulate before the benefits go live.

The Maine Department of Labor (MDOL) will administer the program and has issued (and later revised) proposed rules for the program that are expected to be finalized before year-end.

Who Is Covered?

The PFML rules cover nearly all employers and employees in the state.

- Employer means any employer with at least one employee in Maine, including both private and public employers (but excluding the federal government). In the case of certain employee leasing arrangements, the client company is the employer for PFML purposes, according to the MDOL’s proposed rule.

- Employee means any employee in Maine. Independent contractors are not covered.

PFML Premium Requirements

Beginning January 1, employers must remit premiums for each employee and may withhold up to 0.5% of employee wages to contribute to the required premium amount.

Premium Contribution Rates (for 2025, 2026, and 2027)

The required premium amount is calculated based on a combined contribution rate. That rate depends on whether the employer had 15 or more Maine employees (whether full-time, part-time, seasonal, or per-diem) on its payroll each week for at least 20 of the weeks within October 1, 2023, and September 30, 2024.

- An employer that meets the 15-employee threshold must contribute 0% of wages (and may deduct up to half of the contribution from the employees’ wages); and

- An employer that does not meet the 15-employee threshold must contribute 5% of wages (and may deduct the entire amount from the employees’ wages).

For this purpose, “wages” generally means all remuneration for personal services performed in Maine (or wages that are otherwise subject to the state’s unemployment tax), including tips and gratuities, severance and terminal pay, commissions, and bonuses.

Withholding and Remitting Premiums

Employee withholdings for premiums begin with the first pay date in January 2025.

All employers must register in the Paid Leave Portal (coming soon to the MDOL website) and may designate a payroll provider during the registration process. Premiums and contribution reports must be submitted quarterly through the portal and no later than:

- April 30, for premiums accrued during January - March;

- July 31, for premiums accrued during April - May;

- October 31, for premiums accrued during June - August; or

- January 31, for premiums accrued during September - December.

More nuanced details are covered in Section X of the MDOL’s proposed rule.

Consequences of Non-Compliance

If an employer fails to timely remit premiums (in whole or in part) or submit contribution reports:

- the MDOL may assess a penalty of 1.0% of the employer’s total payroll for the applicable quarter; and

- the employer will be liable for the full amount of any PFML benefits paid to covered individuals for whom it failed to make premium contributions.

The agency will notify employers of any delinquent contribution reports within 15 days of the applicable due date (and may give the employer an opportunity to correct delinquent payments or contribution reports before imposing a penalty). In any event, employers may appeal assessed penalties for failures to pay.

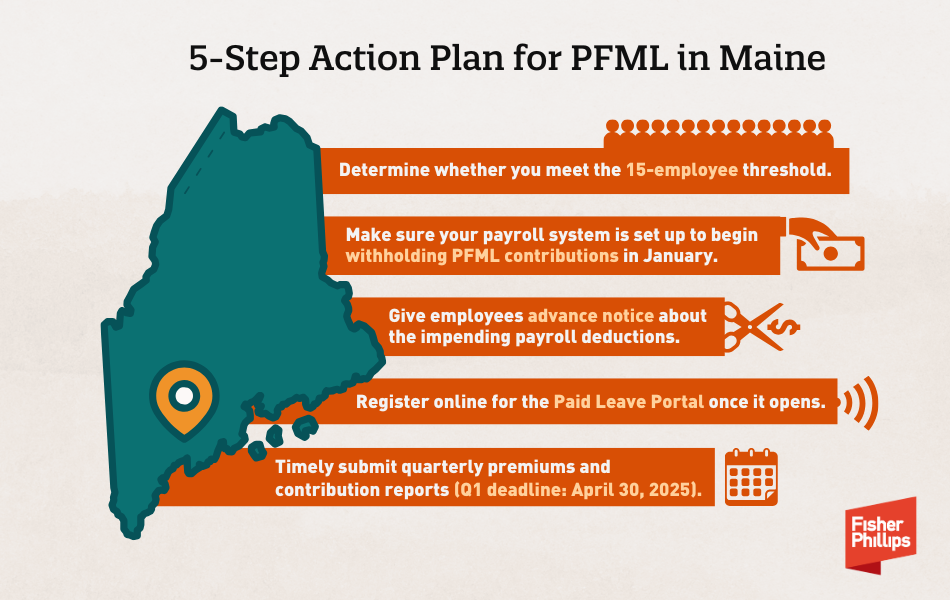

Your 5-Step Action Plan

While you still have some time to prepare before PFML benefits begin in 2026, you must act now to prepare for the premium contribution requirements that take effect in January. Here’s your 5-step action plan:

1. Determine whether you meet the 15-employee threshold. Work with counsel if you have any questions regarding which individuals must be counted for this purpose.

2. Make sure your payroll system is set up to begin withholding PFML contributions in January. Work with your payroll provider to ensure a smooth rollout.

3. Give employees advance notice about the impending payroll deductions. You may use this poster to provide the relevant information.

4. Register online for the Paid Leave Portal once it opens. Be prepared to designate your payroll provider (if applicable) and identify whether you meet the employee threshold.

5. Timely submit premiums and contribution reports through the portal. The first submission will be due no later than April 30, 2025.

Conclusion

We will continue to monitor further developments on Maine’s new PFML program and provide updates on this and other labor and employment issues affecting Maine employers, so make sure you are subscribed to Fisher Phillips’ Insights to gather the most up-to-date information. If you have questions, please contact your Fisher Phillips attorney or the author of this Insight.

Related People

-

- Joshua D. Nadreau

- Regional Managing Partner and Vice Chair, Labor Relations Group