FP SCOTUS Predictions: Justices Will Hand Win to Employers By Rejecting Higher Standard of Proof in Overtime Exemption Cases

Insights

11.22.24

What evidence does an employer need to show a court to prove it correctly classified employees as exempt from minimum wage and overtime pay? The Supreme Court recently heard oral arguments in a case raising this question and seems poised to agree with the employer that an unusually high “clear and convincing” evidence standard does not apply to federal wage law. Employers will want to pay close attention since the decision will impact your litigation strategy when employees claim they were misclassified and owed wages and overtime premiums. It will also have practical implications when determining whether to classify your employees as exempt or non-exempt. Here are the key points you should know and our specific predictions on how SCOTUS will decide the case.

What Are the Key Points for Employers?

Exempt Classification Challenged: In E.M.D. Sales Inc. v. Carrera, several employees of a grocery distribution company claimed they were misclassified as outside sales employees and were therefore owed overtime pay. Under the Fair Labor Standards Act (FLSA), employees generally must be paid an overtime premium of 1.5 times their regular rate of pay for all hours worked beyond 40 in a workweek — unless they fall under an exemption.

While the executive, administrative, and professional exemptions — which are collectively known as the “white-collar” exemptions – may be the most familiar to employers, this case focuses on the outside sales exemption. Under this exemption, the employee’s primary duties must involve making sales, and the employee must be customarily and regularly engaged away from the employer’s place of business. You should note, however, that the Supreme Court’s ruling will likely impact all 34 of the FLSA’s exemptions.

Why It Matters to Employers: Misclassifying employees based on their exemption status is a key compliance issue, especially as federal and local agencies ramp up enforcement and the cost of potential class and collective actions skyrockets. The default under the federal FLSA is that an employee is non-exempt – and when exempt status is questioned, the employer has the burden of proving that it properly classified an employee as exempt.

Disagreement Among Courts: In a FLSA misclassification claim, there is a split among the federal appeals courts as to what standard of proof the employer must meet:

- A “preponderance of the evidence” standard, which is a lower threshold (that some scholars say means a 51% chance the employer is correct); or

- A more-stringent “clear and convincing” standard (that some scholars translate to an 80-90% chance the employer is correct).

In E.M.D. Sales, the 4th U.S. Circuit Court of Appeals applied the clear and convincing standard, making it the sole federal appeals court to do so. In contrast, six other federal appeals courts (the 5th, 6th, 7th, 9th, 10th, and 11th) have applied the preponderance of the evidence standard. Thus, SCOTUS accepted the case to address this disagreement and will hopefully set a consistent standard nationwide.

SCOTUS Impact: Not only will the SCOTUS decision impact the burden of proof for litigation purposes, but it will also have practical implications as to how employers classify their employees. If SCOTUS endorses the clear and convincing evidence standard, employers will certainly want to take a closer look at employees’ exemption classifications. And when a job falls within a gray area, you will want to evaluate the risk associated with continuing to classify the position as exempt.

How Did the SCOTUS Oral Arguments Go?

Employer’s Arguments: The attorney for the employer argued that nothing in the FLSA’s text suggests that Congress intended a clear and convincing evidence standard to apply to the 34 exemptions under the FLSA. Indeed, the preponderance standard applies to rights against race and disability discrimination and rights to organize and to workplace safety – which are “all super important rights,” she noted.

“For over a century, this Court has held that the default standard in civil cases is preponderance of the evidence,” she said. “That default rule should resolve this case.”

Employees’ Arguments: The attorney for the employee argued that the clear and convincing standard of proof is necessary to carry out the FLSA’s public purpose. The FLSA is designed to quickly eliminate labor conditions that fall below a minimum standard of living, she said. “The preponderance of the evidence standard falls short of that purpose because it allocates the risk of factual error equally between employers and workers.”

She added that the statute “protects both the worker's right to a fair day’s pay for a fair day’s work” and “also the public's right to an economic system that doesn't depend on and inexorably lead to the impoverishment and immiseration of the American worker.”

SCOTUS Probes: The Justices seemed reluctant to apply a higher standard to the FLSA than other civil rights statutes, like the National Labor Relations Act (NLRA), the Occupational Safety and Health Act (OSH Act), the Americans with Disabilities Act (ADA), and Title VII of the Civil Rights Act.

Justice Alito noted that the government provides lots of monetary benefits that are critically important to some people. “Would you have us say that none of those can rise to the level of importance that is present when what’s involved is overtime payments under the FLSA?” he asked the employees’ attorney. “Say it’s a determination of welfare benefits. Is that less important than this?”

The employees’ attorney said, “Certainly not.” But she took the position that the FLSA is unique in terms of its breadth, statement of purpose, remedial nature, and the fact that employees cannot waive their rights under the FLSA. An “operative question is whether those rights are waivable by the individual.”

Chief Justice Roberts seemed to have the same concerns as Justice Alito and asked about the Clean Water Act. “There’s a big statement of purposes there.” So, why isn’t there a higher standard of proof for someone to show they’re not polluting the environment?

Counsel for the employees again argued that the non-waivable nature of the FLSA’s protections somehow makes the statute special and deserving of a higher burden of proof regarding exemptions. However, the employer’s attorney pointed out that other worker rights, such as NLRA rights, are also not waivable. Thus, she argued this is not a key distinction.

FP SCOTUS Prediction: Justices Will Rule in Favor of the Employer

Preponderance of the Evidence Standard Expected to Prevail: We predict the SCOTUS majority will hold that the preponderance of the evidence standard applies, not the higher clear and convincing standard. The issues in this case echo the Supreme Court’s 2018 Encino Motors decision, where the Court rejected arguments that the FLSA’s exemptions should be narrowly construed. We expect the majority will follow the same logic here. There is no constitutional or statutory basis to apply a higher burden of proof to employers under the FLSA, and there is also no important liberty interest at stake.

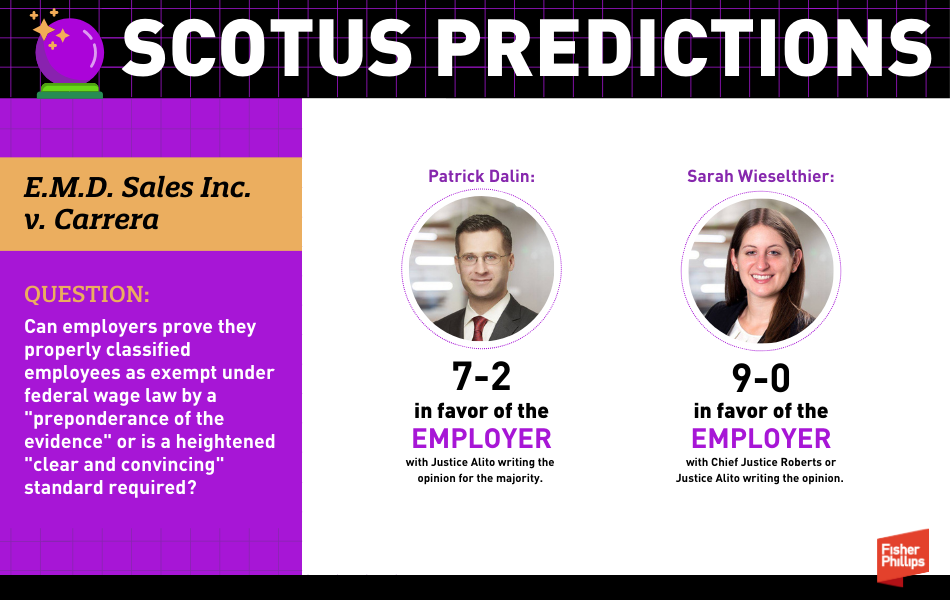

Sarah Wieselthier: I predict SCOTUS will rule 9-0 in favor of the employer, reversing the 4th Circuit and remanding the case for the lower courts to determine whether the exemption's duties test is satisfied by the lower preponderance standard. I anticipate Chief Justice Roberts or Justice Alito will write the opinion given that they pressed the most on why a heightened standard should be used when it's not in cases under other important employment statutes.

Patrick Dalin: I expect the Court to hold that the preponderance of the evidence burden applies here, as is standard. SCOTUS will decide 7-2 in favor of the employer with Justice Alito writing the opinion for the majority.

Conclusion

Even if SCOTUS resolves this case in favor of the employer – as we predict it will – wage and hour compliance should be top of mind since errors can result in significant penalties and hefty litigation costs. The best way to avoid misclassification claims is to ensure you regularly review your practices. Check out our Wage and Hour Insights page for the latest compliance tips.

We will continue to monitor developments from SCOTUS and the DOL’s Wage and Hour Division, so make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. For further information, contact your Fisher Phillips attorney, the authors of this Insight, or any attorney in our Wage and Hour Practice Group.

Related People

-

- Patrick M. Dalin

- Partner

-

- Sarah Wieselthier

- Partner