Employer FAQs on Connecticut’s New Paid Sick Leave Rules Coming January 1

Insights

12.23.24

Connecticut employees will have much broader paid sick leave rights starting January 1, and employers must be ready to comply with the expanded requirements. A new state law not only significantly increases the number of employers that must offer paid sick days (as well the number of employees entitled to receive it) but also expands the reasons why an employee may take that paid time off. Connecticut employers also must be aware of other changes, including quicker accrual rates for paid sick leave and a new employee notice requirement. We’ll answer your frequently asked questions and give you a five-step action plan for compliance.

What Happened?

Gov. Ned Lamont signed a bill into law (Public Act No. 24-8) earlier this year that replaces many of Connecticut’s existing paid sick leave rules starting January 1. The new law will, among other things, cover many more workers in the state. In a press release issued in May, State Senator Julie Kushner said: “More than a decade ago, Connecticut was a national leader in requiring certain service sectors to provide paid sick days to their employees – but only a fraction of Connecticut's workforce was covered. Since 2011, we’ve stood still while other cities and states have exceeded what we started. In the daily race to attract new residents and new jobs, standing still is not an option.”

Which Employers Must Comply?

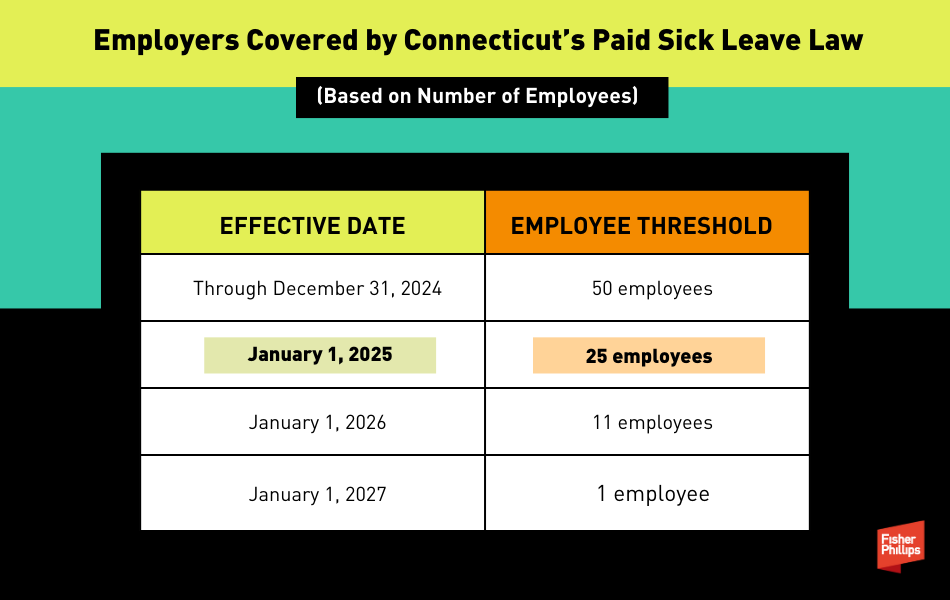

Connecticut’s existing paid sick leave rules generally apply to employers with more than 50 employees in the state (unless an exemption applies) – but the new rules will lower that employee threshold (and therefore increase the number of covered employers) in three phases:

Which Employers Will Be Exempt?

The exemption categories will be changing, too.

- Current Exemptions. Under the current rules, most manufacturing and nonprofit employers are exempt. This exemption will expire effective January 1, so employers in these categories will become required to comply so long as they meet the employee threshold and do not otherwise qualify for the new exemptions.

- New Exemptions. Effective January 1, the only employers who will be exempt from the paid sick leave rules are: (1) certain employers that participate in a multiemployer health plan pursuant to a collective bargaining agreement with a construction union; and (2) self-employed individuals.

Which Employees Are Covered?

Currently, only certain types of employees (including, primarily, workers in specific retail and service jobs – such as food service and healthcare workers) in Connecticut are entitled to the state’s paid sick leave protections. Starting January 1, however, workers of nearly every occupation will be protected.

How Will Accrual Rates Change?

Covered employees will be entitled to accrue one hour of paid sick leave for each 30 hours worked. (Under existing rules, the accrual rate is one hour for each 40 hours worked).

In addition, the new rules will allow employers to opt out of the carryover requirement. Employers will therefore be required to either allow employees to carry over up to 40 hours of unused accrued paid sick leave into the following year or frontload paid sick leave so that an employee’s entire annual amount is available for immediate use at the beginning of the year.

When Will Employees Become Entitled to Use Accrued Paid Sick Leave?

Under the new rules, a covered employee will be entitled to use accrued paid sick leave starting 120 calendar days after their starting the job. (Under current rules, employees don’t become entitled to use accrued paid sick leave until they’ve completed 680 hours of employment.)

What’s Changing About the Qualifying Purposes for Taking Paid Sick Leave?

The new law will also broaden the qualifying purposes requiring paid sick leave, including by expanding who qualifies as a “family member” under the law and adding two new qualifying purposes.

- Expanding Who Qualifies as a Family Member. Connecticut’s existing law requires covered employers to permit employees to use accrued paid sick leave to care for their spouse or minor child in certain circumstances. The new law greatly expands who qualifies as an employee’s family member for this purpose and will also include the employee’s sibling, grandparent, grandchild, registered domestic partner, or even “any individual related to the employee by blood or affinity whose close association the employee shows to be equivalent to those family relationships.”

- Adding Two New Qualifying Purposes. Beginning January 1, employees may use accrued paid sick leave for two new purposes, in addition to the existing qualifying purposes. This will include sick leave rights based on closure of the employee’s workplace or a family member’s school or place of care due to a public health emergency, or based on a determination that the employee (or the employee’s family member) poses a risk to the health of others due to their exposure to a communicable disease.

What Else Is Changing?

The new rules make various other important changes. For example, employers will be:

- prohibited from requiring an employee to provide any documentation that paid sick leave is being taken for a qualifying purpose;

- prohibited from conditioning the employee’s ability to use paid sick leave on the employee looking for a replacement worker;

- required to provide written notice (click here for the state’s model notice) to each employee by January 1, 2025 (or at the time of hire, if later) – in addition to the existing poster requirements; and

- required to keep adequate records regarding each employee’s accrual and use of paid sick leave, and to retain those records for at least three years.

5 Practical Steps for Connecticut Employers

To prepare for these impending changes, you should consider taking these five steps:

- Review and revise your internal policies to align with the new law.

- Update your employment handbooks to reflect the expanded entitlement and usage of sick leave.

- Implement robust tracking systems for accrual, usage, and carry-over of leave.

- Train HR staff and management on the new obligations.

- Make sure you comply with the new employee notice and record retention requirements.

Conclusion

We will continue to monitor developments related to Connecticut’s paid sick leave requirements, as well as all developments related to workplace law. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. If you have questions, contact your Fisher Phillips attorney, the author of this Insight, or any attorney in our Boston office.

Related People

-

- Jeffrey A. Fritz

- Partner